You've screened down to 36 potential investments. Now you need to rank them (and not by P/E ratio, but by "founder alignment with shareholders", "strength of competitive moat", or "execution track record"). Traditional tools can't rank by qualitative judgment. This tutorial shows how to rank founder-led S&P 500 companies by custom investment criteria using AI, turning a subjective thesis into a quantified ranking for $3.34.

My Problem: The Founder-Led Investment Thesis

Investors are always on the lookout for screens that identify stocks likely to outperform the market. One idea frequently mentioned is that founder-led companies deliver above-average returns. Recent research from Bain found that founder-led companies outperformed their non-founder-led counterparts by 2.1x in total shareholder returns from 2015-2024.

Does it still hold true today, in 2026? If so, how strong is the signal?

The first step is the most difficult: finding which S&P 500 companires are founder-led. A natural first step is to ask the best LLM chatbots to see if they can generate that list.

ChatGPT, Claude, Grok, and Gemini Try To Research 500 Companies

We put the major models to the test, including using our own tool everyrow.io.

The challenge, of course, is that 500 companies is a lot, and who the founders and current CEOs are is surprisingly not obvious in many cases.

Model | Companies found |

|---|---|

| ChatGPT-5.2 | 27 |

| Gemini 3 Pro | 25 |

| Grok Expert | 18 |

| Opus 4.5 | 16 |

| everyrow.io | 36 |

These use the paid (pro/plus) tiers of each chatbot, with web search and "extended thinking" enabled. The correct list of 36 is at the bottom of this post.

While the major models found most of the founder-led companies, they missed more obscure S&P 500 companies like Invitation Homes and Monolithic Power Systems. When asked about these companies individually, the models correctly identify them. But opening 500 ChatGPT tabs is not a realistic solution.

everyrow.io/screen solves this problem by using a web research agent on every row to ensure it gets the right answer.

How to run an LLM web agent on every row of a table

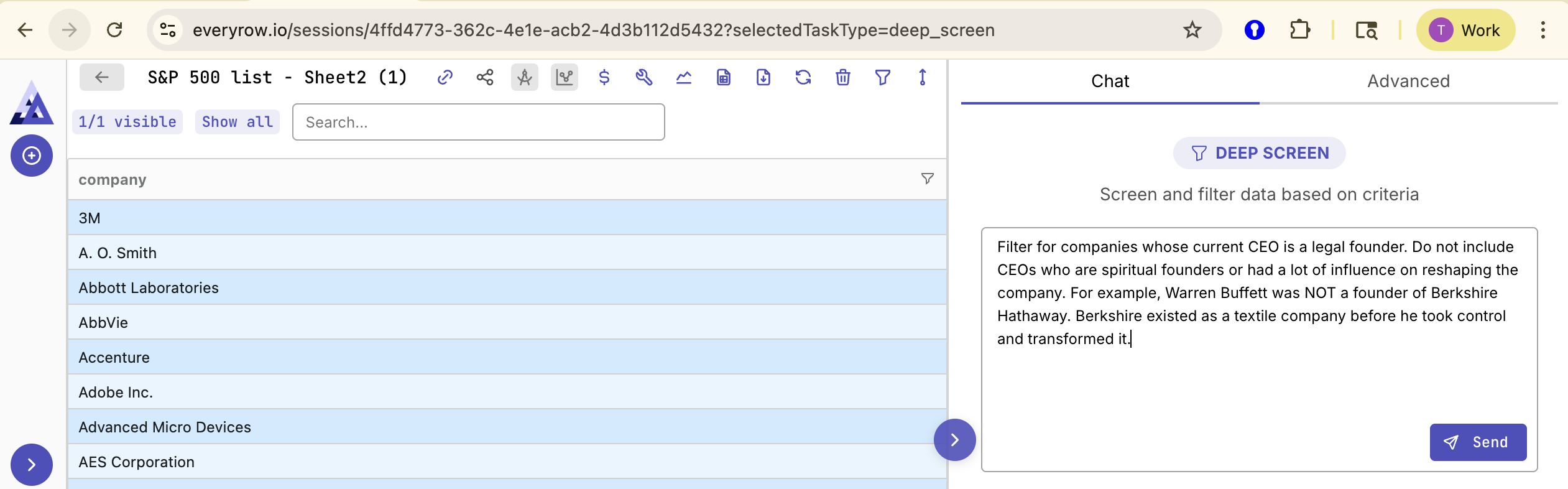

Using everyrow, I uploaded a CSV file with the S&P 500 companies. Then I entered a description of how to filter them.

Surprisingly, the definition of a founder is more ambiguous than one might initially imagine. Elon Musk's name was not on the founding documents of Tesla. However, a lawsuit settled in 2009 determined that Elon Musk is in fact a founder of Tesla.

The screenshot below shows the prompt I used:

The screen utility then filtered down to those companies matching that criteria, which I verified as correct by hand. I then asked everyrow to find the last 4 years' stock returns and calculated the average return. (Full disclaimer: There were a couple minor errors/ambiguities in the stock returns that I manually corrected.)

You can see my table here.

For screens, everyrow.io does up to 50 rows free, and then it's as little as a few cents per row for the rest of your table. Screening the S&P 500 for founder-led companies and finding their returns cost $3.34 and took about 15 minutes.

So... Do founder-led companies outperform? YES!

A handful of founder-led companies, like Robinhood and Coinbase, went public in 2021. To ensure they were included, we calculated returns from January 1, 2022, to January 1, 2026. We found that founder-led companies returned 118% during those four years, handily outperforming the S&P 500's total return of approximately 59%.

For reference, here is the correct list (as of Jan 15, 2026) of founder-led S&P 500 companies, if you want to analyze them for things other than returns.

Company |

|---|

| Airbnb |

| Akamai Technologies |

| Apollo Global Management |

| AppLovin |

| Ares Management |

| Axon Enterprise |

| BlackRock |

| Blackstone Inc. |

| Block, Inc. |

| Camden Property Trust |

| Capital One |

| Carvana |

| Coinbase |

| CoStar Group |

| CrowdStrike |

| Datadog |

| Dayforce |

| Dell Technologies |

| DoorDash |

| Fortinet |

| Intercontinental Exchange |

| Invitation Homes |

| Meta Platforms |

| Monolithic Power Systems |

| Nvidia |

| Palantir Technologies |

| Paramount Skydance Corporation |

| Paycom |

| Regeneron Pharmaceuticals |

| Robinhood Markets |

| Salesforce |

| Steel Dynamics |

| Supermicro |

| Tesla, Inc. |

| Trade Desk (The) |

| Verisign |