Key Takeaways

- Ford F-150 monthly payments could exceed **900)

- Tariffs on Chinese auto parts scheduled to drop to 25% in May, down from higher levels

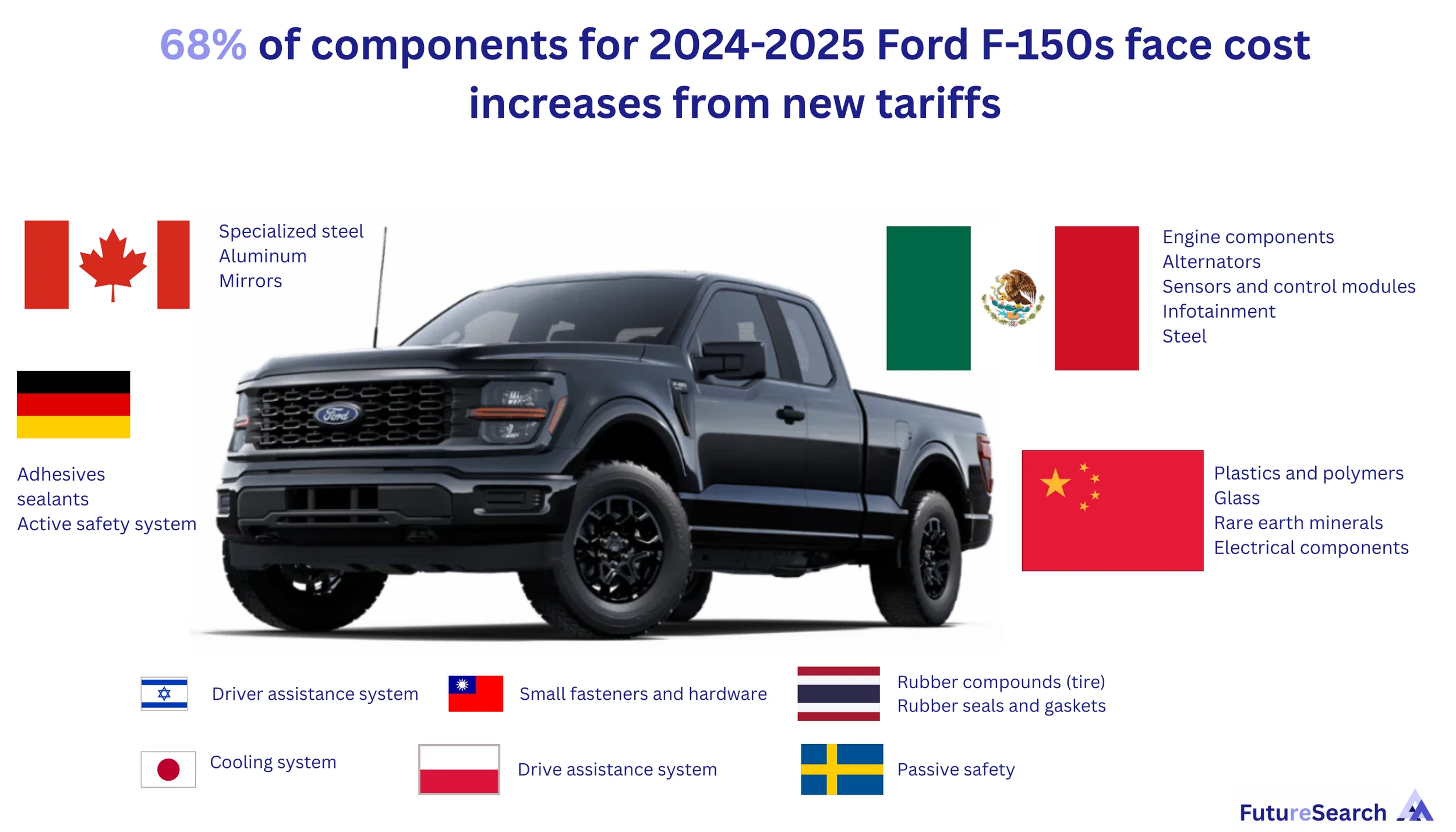

- American-made vehicles use nearly 68% foreign components, making them vulnerable to tariff increases

- Manufacturing cost increases estimated at 10-20% of current retail prices

- Potential average cost increase of $6,000 per F-150 truck

- Even "American-made" goods will become significantly more expensive due to imported components

Tariffs on American-Made Goods: The Hidden Impact

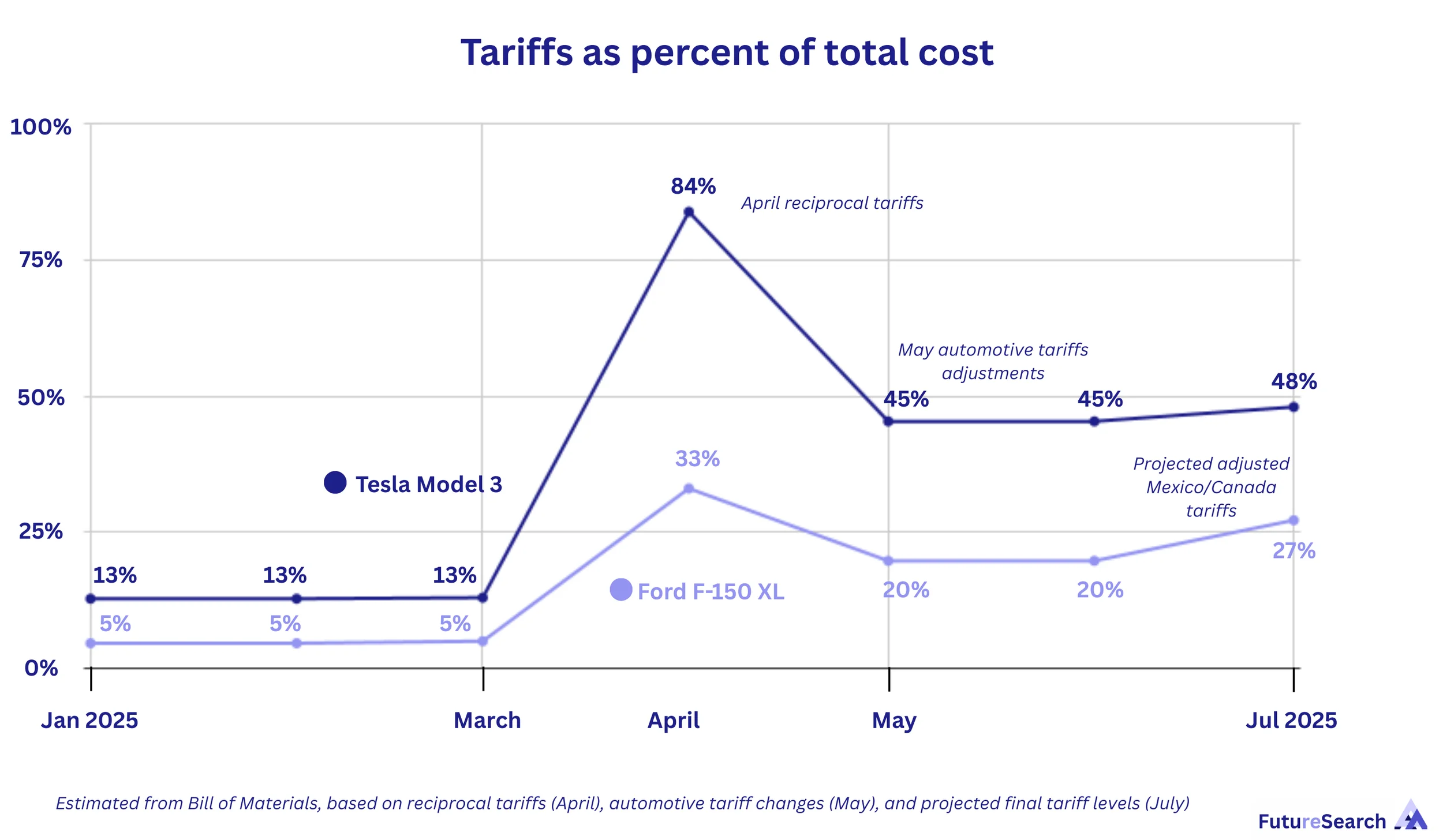

Much has been said about how the April "reciprocal tariffs"—Trump's "Liberation Day" tariffs—now paused until July, will affect the cost of foreign-made goods to American consumers. (Not to mention the stock market!)

But what about the cost of American-made goods to American consumers?

This analysis examines how tariffs will impact two iconic American vehicles: the Ford F-150 pickup truck and the Tesla Model 3, both manufactured in the United States but heavily dependent on imported components.

The Reality: American Manufacturing Depends on Global Supply Chains

US manufacturers heavily depend on foreign parts, with nearly 68% of vehicle components sourced internationally. This means tariffs on imports directly increase the manufacturing costs of "American-made" vehicles.

The impact varies by country of origin:

- China: Largest source of auto parts, facing the highest tariff rates

- Mexico and Canada: Major suppliers under USMCA trade agreement

- Other countries: Various tariff rates based on trade relationships

Ford F-150: America's Best-Selling Truck Faces $6,000 Price Increase

The Ford F-150, America's best-selling vehicle for decades, exemplifies the tariff challenge for US manufacturing.

Current Situation

- Average monthly payment: Over $900

- Manufacturing components: Sourced from multiple countries

- Retail price: Varies by trim level and configuration

Tariff Impact

With the new tariff structure, manufacturing costs are expected to increase 10-20% of current retail prices, translating to:

- Estimated cost increase: $6,000 per truck

- New average monthly payment: Over $1,000

- Impact on affordability: Substantial reduction in consumer purchasing power

The F-150's dependence on imported components means manufacturers will likely pass most increased costs to consumers through higher vehicle prices.

Tesla Model 3: Even Electric Vehicles Can't Escape Tariffs

Tesla's Model 3, manufactured in the United States and marketed as an American-made vehicle, also faces significant tariff impacts.

Key Differences from F-150

- Raw materials: Almost entirely from US sources

- Component assembly: Domestic manufacturing

- Battery supply chain: Mix of domestic and imported materials

Tariff Vulnerability

Despite greater domestic manufacturing, the Model 3 still uses imported:

- Electronic components

- Specialized materials

- Battery components and rare earth elements

The total cost impact varies based on the specific configuration and supply chain dependencies.

Auto Parts Tariff Changes

A critical development: Tariffs on Chinese auto parts are scheduled to drop to 25% in May, down from previously higher levels. However, this still represents a significant cost increase compared to pre-tariff levels.

This reduction provides some relief but doesn't eliminate the fundamental challenge: US auto manufacturing depends heavily on imported components, making it inherently vulnerable to tariff policies.

The Broader Economic Impact

Manufacturers' Limited Options

When tariffs increase component costs, manufacturers face three choices:

- Absorb the costs: Reduce profit margins (unlikely given competitive pressures)

- Pass costs to consumers: Raise vehicle prices (most likely outcome)

- Shift supply chains: Find alternative suppliers (slow and expensive process)

Consumer Impact

The practical effect is that "American-made" vehicles become less affordable for American consumers, with monthly payments rising beyond many families' budgets.

For the F-150 specifically:

- Current average payment over $900/month is already near affordability limits

- Additional 1,000/month threshold

- This affects not just new buyers but the entire used vehicle market

Manufacturing Competitiveness

Higher input costs also make US-manufactured vehicles less competitive internationally, potentially reducing export opportunities and undermining the tariffs' stated goal of strengthening domestic manufacturing.

Methodology and Limitations

Data Sources

- Average vehicle prices from industry reports

- Component sourcing data from trade statistics

- Tariff rates from official government schedules

- Manufacturing cost estimates from industry analysis

Key Assumptions

- Manufacturers pass most tariff costs to consumers

- Supply chains remain largely unchanged in short term

- Tariff rates remain as currently scheduled

- No major policy changes or exemptions

Limitations

- Actual manufacturer cost structures are proprietary

- Supply chain complexity makes precise calculations difficult

- Policy changes could alter tariff rates

- Market dynamics may affect how costs are distributed

The Bottom Line

Tariffs will significantly increase the cost of American-made goods, particularly vehicles. The Ford F-150, America's best-selling truck, could see price increases of 1,000 for the first time.

The paradox: Policies intended to protect American manufacturing may make American-made goods less affordable for American consumers, while also reducing the competitiveness of US manufacturers in global markets.

As tariff policies continue to evolve, consumers and manufacturers alike face uncertainty about future costs and market dynamics.

Related Reading

- Here's How Much More a Tesla Model 3 Could Cost Due to Tariffs (NASDAQ, May 9, 2025)

- Here's How Much More a Ford F-150 Could Cost Due to Tariffs (AOL, May 9, 2025)

- Future Forward: AI, Forecasting, and the Tariff Effect (InsideAnalysis podcast, April 24, 2025)