Stock screeners filter by P/E ratio, market cap, and dividend yield - all quantitative metrics. But what if you want to find "companies with significant AI exposure" or "stocks with low climate transition risk"? Traditional screeners can't filter by themes, narratives, or qualitative criteria. This tutorial shows how to screen 502 S&P 500 stocks by custom thematic criteria using AI, filtering for strategic factors that financial metrics don't capture.

My Problem

I wanted to find stocks that tick two boxes: recurring revenue over 75%, and positioned to benefit from Taiwan tensions. Defense contractors making money from military spending. Cybersecurity firms thriving in a heightened threat environment. Utilities in Georgia and the Carolinas powering CHIPS Act fabs.

Not a weird thesis. But try putting it into Finviz.

You can't. Finviz has 70+ filters - P/E, market cap, RSI, insider ownership - but nothing for "what percentage of revenue is recurring" or "would this company benefit if China invades Taiwan." Same story with TradingView, Bloomberg, Capital IQ. They filter on numbers that exist in databases. My criteria require actually understanding each business.

So I ran it through everyrow.io/screen instead. 63 of 502 S&P 500 companies passed, in 12 minutes for $3.29.

The screen

stocks = pd.read_csv("S&P 500 Companies.csv") # 502 companies

SCREENING_TASK = """

Find companies with high-quality recurring revenue business models that would

also benefit from escalating US-China tensions over Taiwan.

Recurring revenue >75%: Subscription services, long-term contracts,

maintenance agreements, royalty streams. Not one-time product sales.

Taiwan tensions beneficiary: CHIPS Act beneficiaries, defense contractors,

cybersecurity, reshoring plays, alternative supply chain providers.

Exclude companies dependent on Taiwan manufacturing or with significant

China revenue at risk.

"""

result = await screen(session=session, task=SCREENING_TASK, input=stocks)

You can follow the full session here.

How it works

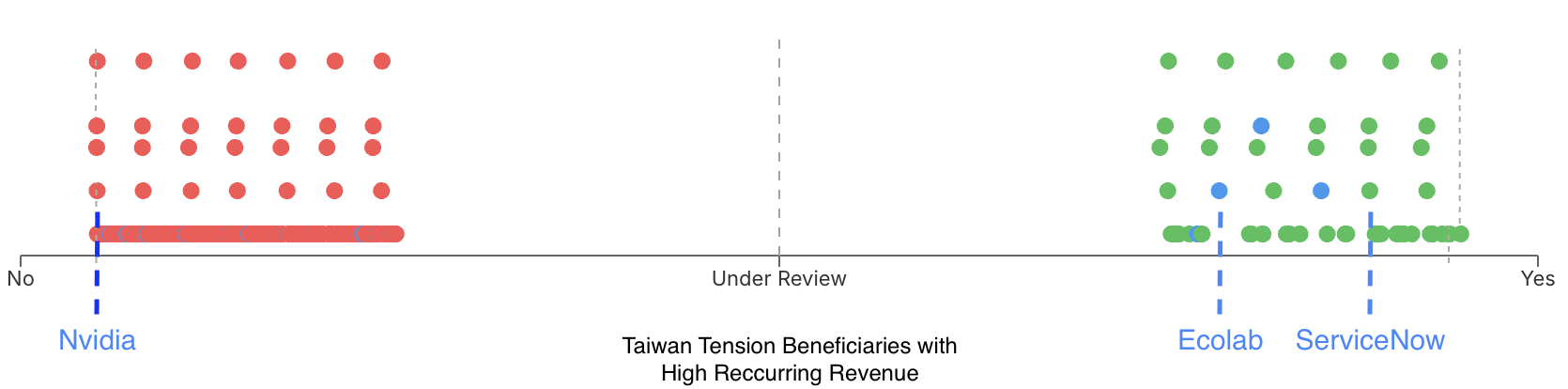

The screen runs in two passes. First, a quick pass through every company to identify clear yes and no cases. Companies that obviously fit (ServiceNow: 97% subscription revenue, DoD contracts) or obviously don't (Nvidia: massive Taiwan dependency) get sorted immediately. The ambiguous ones - companies where the answer requires deeper research - get flagged as "maybe."

Then a second pass works harder on the maybes. More web searches, more careful analysis of revenue breakdowns and supply chain exposure. This is where the interesting edge cases get resolved.

63 companies passed. 12.5% of the S&P 500.

What passed

Ticker | Company | Why |

|---|---|---|

| TMUS | T-Mobile | 81% service revenue, $2.67B Navy contract |

| NOW | ServiceNow | 96.9% subscription, DoD IL4 auth, just bought Armis for $7.75B |

| CRWD | CrowdStrike | 95% recurring, China cyber threats up 150% |

| SO | Southern Company | 90%+ regulated, powering Hyundai/Qcells reshoring in Georgia |

| GD | General Dynamics | M1 Abrams to Taiwan, $100B+ backlog |

| NOC | Northrop Grumman | B-21 bomber, defense prime |

| LDOS | Leidos | 95%+ government contracts |

| DDOG | Datadog | ~90% SaaS |

| DLR | Digital Realty | Data center REIT |

| PLTR | Palantir | ~100% subscription, deep DoD/intelligence ties |

Plus 53 more, including ORCL, CRM, PANW, NEE, CEG, ADP, DUK, WM, AON, CTAS, EQIX, ADSK, WDAY, AXON, WEC, TYL, ECL, WMB, PTC, JKHY.

The reasoning it gives is specific. For T-Mobile:

T-Mobile US (TMUS) meets the criteria. (1) Its revenue is dominated by service revenues (subscriptions), which accounted for approximately 81% of total revenue in 2024, exceeding the 75% recurring revenue threshold. (2) It is a beneficiary of escalating US-China tensions as a defense contractor and national security provider. It was recently awarded a $2.67 billion 10-year contract by the U.S. Navy and serves various agencies under the Department of Defense.

For ServiceNow:

ServiceNow has extremely high recurring revenue, with approximately 97% of its total revenue coming from subscriptions. It is a beneficiary of US-China tensions as its platform is critical for digital transformation, cybersecurity, and US federal government infrastructure; its public sector business grew 30% in early 2025. It has low exposure to China (Asia Pacific accounts for only ~11% of revenue total).

It's pulling actual numbers from 10-Ks and earnings calls, not just pattern-matching on company descriptions.

Edge cases: Ecolab

Some companies need more work. Ecolab (ECL) was flagged as a "maybe" in the first pass:

Ecolab has a highly recurring business model (~90% of revenue from consumables and service contracts). It is a beneficiary of the reshoring trend, providing water and hygiene solutions to new US industrial plants, including semiconductor fabs. While it has some China exposure, its strategic importance to US industrial water management and reshoring makes it a plausible "maybe" - but the prompt asks for companies that see increased revenue from tensions. Ecolab's growth is more broadly tied to US industrial re-investment. On balance, it fits the recurring revenue criteria perfectly but the tension benefit is indirect.

The second pass dug deeper and found it passes:

Ecolab meets the criteria. Approximately 90% of its revenue is recurring, derived from long-term service contracts and consumables. It is a direct beneficiary of the US industrial reshoring trend, providing mission-critical water management and hygiene solutions for new domestic semiconductor fabrication plants and other advanced manufacturing facilities. Its China revenue exposure is approximately 4.43% of total revenue, below the 5% threshold, and it is not dependent on Taiwan-based manufacturing.

Water treatment for CHIPS Act fabs isn't the first thing you'd think of when screening for "Taiwan tensions beneficiaries." But the reshoring trend is real, and Ecolab is positioned to benefit. This is the kind of non-obvious connection the screen surfaces.

What didn't pass

The interesting part is what didn't make it.

Nvidia? Immediate no. TSMC manufactures virtually all of Nvidia's chips in Taiwan - if tensions escalate, that's not a tailwind, it's an existential risk. The screen caught this instantly:

Nvidia fails both criteria: its revenue is primarily transactional (chip sales), and it is heavily dependent on Taiwan manufacturing (TSMC) and has significant China revenue (up to 20-25% historically, though restricted recently) that would be at risk in a conflict.

Apple failed for the same reason. Most of Big Tech failed the geopolitical criterion even when they had decent recurring revenue.

Banks? Out. Transaction-based revenue, not subscriptions.

Pharma? Out. Product sales, not recurring.

Consumer discretionary? Mostly out. One-time purchases.

The intersection of "high recurring revenue" and "Taiwan tensions beneficiary" is narrower than you'd think. The screen found the 12% of the S&P 500 that sits in that overlap: defense contractors, enterprise SaaS, regulated utilities, and infrastructure REITs.

How long it took

Companies screened | 502 |

Passing | 63 (12.5%) |

Cost | $3.29 |

Time | 12 minutes |

Doing this manually - reading 10-Ks, researching supply chains, estimating recurring revenue percentages - would take maybe 15 minutes per company if you're fast. That's 125 hours: three weeks of full-time work.

Try your own thesis

The free tier gives you 50 rows. Enough to test whether a screen works before running it on the full index.

Some ideas:

- "Founder-led companies in software"

- "Companies with > 50% international revenue but < 5% China exposure"

- "Companies that would benefit from AI infrastructure buildout"

If you can describe it, you can screen for it. Try it now at everyrow.io/screen. Or if you prefer code (or have an agent that does), the example above runs with the everyrow-sdk - see the full notebook).