Key Takeaways

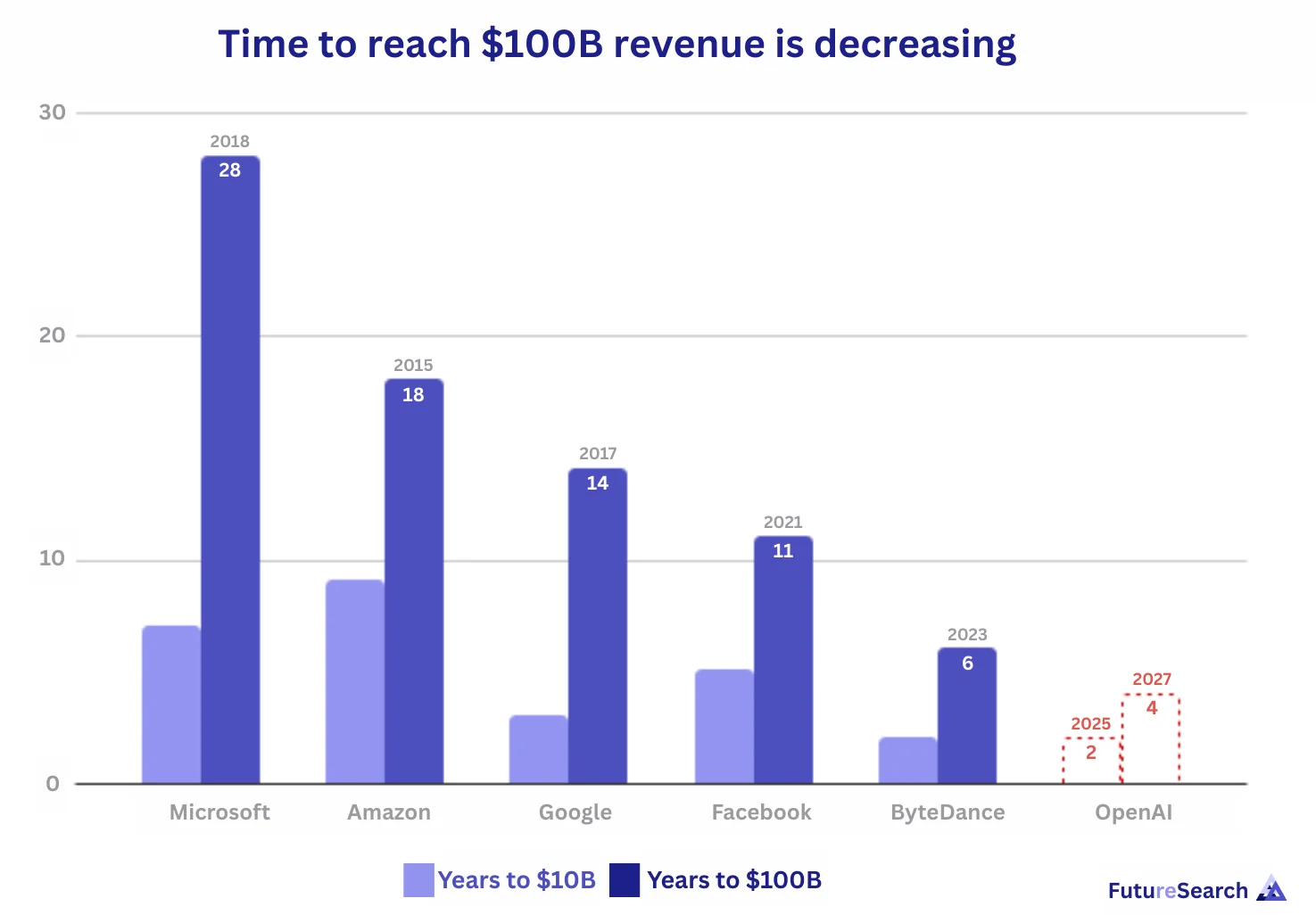

- The record time to go from 100B ARR is dropping by 40% per decade**, and OpenAI could continue that trend

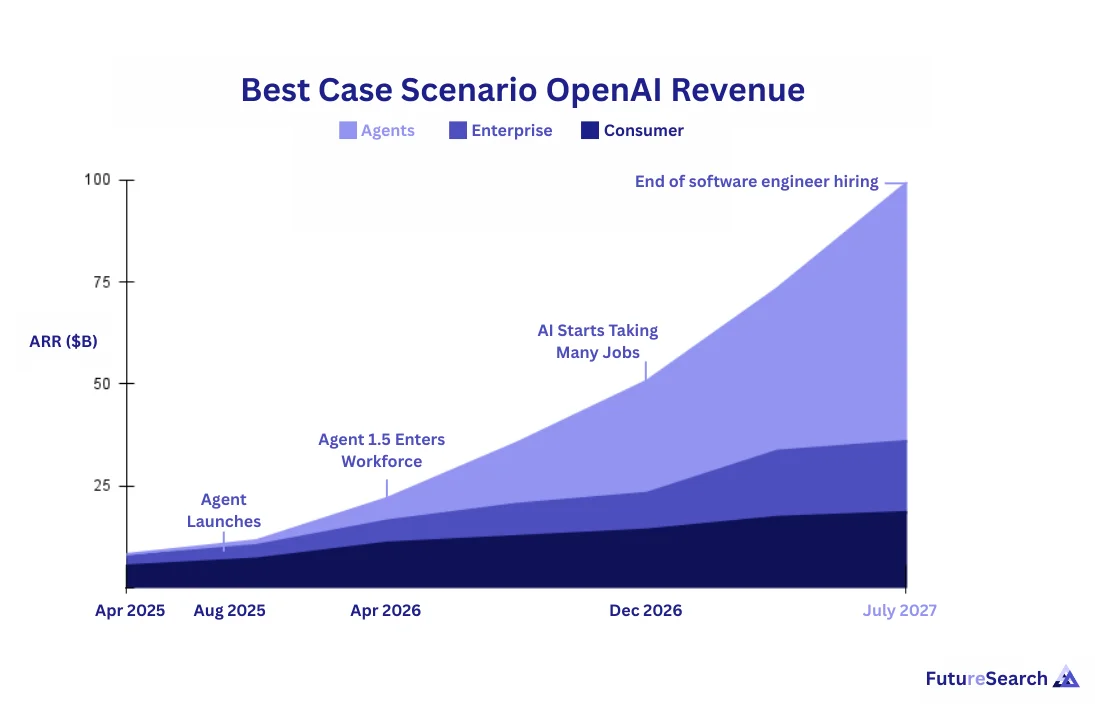

- The only way OpenAI could achieve $100B ARR by mid-2027, consistent with AI 2027, would be from a huge new business in "agents"

- OpenAI's revenue from agents—Operator, Deep Research, Codex, or future products—would have to account for 2/3 of their revenue in just 2 years

- In this scenario, we project consumer revenue growing from 14.5B, and enterprise revenue from 17.4B

- In such takeoff revenue scenarios, API revenue is not a major growth driver compared to agent-based services

- For a full forecast of OpenAI's revenue in 2027, see OpenAI's Revenue in 2027: A Comprehensive Forecast

The AI 2027 Scenario: Can OpenAI Afford an Intelligence Explosion?

FutureSearch was a co-author of parts of AI 2027, a scenario centered around a leading AI company, "OpenBrain", creating an intelligence explosion by building AI that speeds up its own AI research.

That work would be enormously expensive. Could a frontier AI lab—likely OpenAI—generate enough revenue to pull it off?

This analysis explores how OpenAI could reasonably expect to achieve $100B in Annual Recurring Revenue (ARR) by mid-2027, making such an ambitious project financially feasible.

OpenAI's Current Financial Position

As of early 2025, OpenAI has:

- Estimated $7B ARR growing at nearly 200% annualized

- 3.7B in 2024

- Strong growth trajectory across all revenue segments

Since this analysis was published, OpenAI has made massive infrastructure and financial moves consistent with exponential growth ambitions: a 500B valuation in October 2025, becoming the world's most valuable private company.

The question is: what combination of revenue sources could scale OpenAI from ~100B in just over two years?

Four Potential Revenue Sources

We examined four potential revenue drivers for OpenAI:

1. Consumers/ChatGPT for Personal Use

Individual subscriptions to ChatGPT Plus, Pro, and other consumer tiers. This represents the foundation of OpenAI's current business.

2. Enterprise Applications (Co-pilots/Worker Assistants)

Software tools that augment human workers' capabilities, such as:

- Microsoft 365 Copilot

- Custom enterprise AI assistants

- Productivity enhancement tools

3. Replacement Workers as Semi-Autonomous Agents

This is the critical growth category: AI agents that can perform entire jobs or major job functions with minimal human oversight.

4. API Revenue

Direct access to OpenAI's models through APIs. While significant, we ultimately rejected this as a major growth driver compared to agent-based services.

The Path to $100B: Revenue Projections

Our model projects OpenAI reaching $99B ARR by June 2027 through the following breakdown:

| Revenue Source | 2025 Starting | 2027 Projection | Growth Factor |

|---|---|---|---|

| Consumer | 3.8B</td> <td style={{textAlign: 'right', padding: '0.75rem', borderBottom: '1px solid #eee'}}>14.5B | 3.8x | |

| Enterprise | 2.3B</td> <td style={{textAlign: 'right', padding: '0.75rem', borderBottom: '1px solid #eee'}}>17.4B | 7.6x | |

| Agents | 0.5B</td> <td style={{textAlign: 'right', padding: '0.75rem', borderBottom: '1px solid #eee'}}>62.6B | 125x | |

| Total | 6.6B</strong></td> <td style={{textAlign: 'right', padding: '0.75rem', borderBottom: '2px solid #ddd'}}><strong>94.5B | 14.3x |

The most dramatic growth comes from the AI Agent category, which transforms from a nascent market in 2025 to the dominant revenue driver by 2027.

AI Agent Market Analysis: Five Key Segments

The explosive growth in AI agents comes from replacing or augmenting human workers across five major categories:

1. Assistants

Personal and executive assistants who schedule meetings, manage communications, and coordinate activities. The global market for administrative support is vast, and AI agents can perform these tasks at a fraction of the cost.

2. Customer Service Representatives

One of the largest addressable markets for AI agents. Customer service employs millions globally, and AI agents can handle routine inquiries, troubleshooting, and even complex problem-solving with increasing sophistication.

3. Knowledge Workers

Analysts, consultants, and information workers who synthesize data, create reports, and provide insights. AI agents with access to relevant data sources and reasoning capabilities can perform much of this work.

4. Software Engineers

AI coding agents that can write, debug, and maintain software. This represents a high-value market where even modest penetration generates substantial revenue.

5. R&D Researchers

Perhaps the most critical for the AI 2027 scenario: AI agents that can conduct research and development, including AI research itself. This creates the potential for recursive self-improvement.

Why Agent Revenue Is the Key Growth Driver

AI agents offer several advantages that drive explosive revenue growth:

Higher pricing power: Agents that replace full-time workers can be priced at a significant fraction of worker salaries while still providing massive cost savings to customers.

Massive addressable market: The global labor market for knowledge work is measured in trillions of dollars annually.

Rapid capability improvements: As models improve, agents can handle increasingly complex tasks, expanding the addressable market.

Network effects: Successful deployments drive further adoption across industries.

The Bottom Line: $100B ARR Is Plausible

This analysis demonstrates that OpenAI could reasonably achieve $100B ARR by mid-2027 by considering:

- Current financial statistics: Strong baseline growth from $7B ARR

- Growth trends: Continuation of 200%+ annual growth in key segments

- Market sizes for AI agents: Multi-trillion dollar addressable market in global knowledge work

The revenue would be sufficient to fund the enormous compute infrastructure required for the AI 2027 "intelligence explosion" scenario, where AI systems begin to meaningfully accelerate their own development.

Critical assumption: This projection requires AI capabilities to continue improving at recent rates, enabling agents to perform increasingly complex knowledge work reliably.

Implications for AI Development

If OpenAI (or a competitor) can achieve this revenue trajectory, it would:

- Enable unprecedented compute spending on training runs costing tens of billions

- Fund massive inference infrastructure to deploy agents at global scale

- Support large research teams working on algorithmic improvements

- Create alignment and safety resources proportional to capability advances

The financial feasibility of the AI 2027 scenario depends critically on AI agents becoming reliable enough to drive this revenue growth.