Value investors agree that investments should be based on accurate forecasts of cash flows over 10+ years. With Stockfisher, for the first time, you can easily screen the entire market for the highest such returns.

Forecasted returns for the largest US semiconductor companies, on the free tier of Stockfisher.

A Better Way To Find Value

The world of stock tools and sell-side research doesn't serve value investors. They focus on the next quarter or year; or they don't cover all publicly traded stocks; or they focus on exit multiples instead of cashflows; or they have incentives other than accuracy.

Stockfisher lets investors do what they're taught in Finance 101: value companies based on the long-term cash flows to shareholders. The result is a simple internal rate of return for every company that a long-term investor will earn if the forecasts are accurate.

Compare Every Company Apples-to-Apples

The best part is that you can do an apples-to-apples comparison for every company. Within 30 seconds of going to Stockfisher (no sign-in required!), you can see the highest expected long-term return based on today's prices.

Whether you're comparing semiconductor manufacturers, consumer goods companies, or industrial firms, Stockfisher provides consistent, rigorous analysis across sectors so you can identify where the market is mispricing long-term value.

Choose Accuracy Over Sentiment

This is all possible because of how Stockfisher does qualitative research at quantitative scale. We hold an exacting standard on both financial calculations and strategic considerations, and apply it consistently to every company.

While other tools focus on multiples and market sentiment, Stockfisher studies the fundamentals of every company. It researches the last 10 years of financial documents, assesses macro trends, and even judges management's reliability when factoring in their own projections.

Management Reliability Analysis

One critical innovation is how Stockfisher assesses management credibility. Rather than taking management guidance at face value, Stockfisher evaluates their track record on stated outcomes.

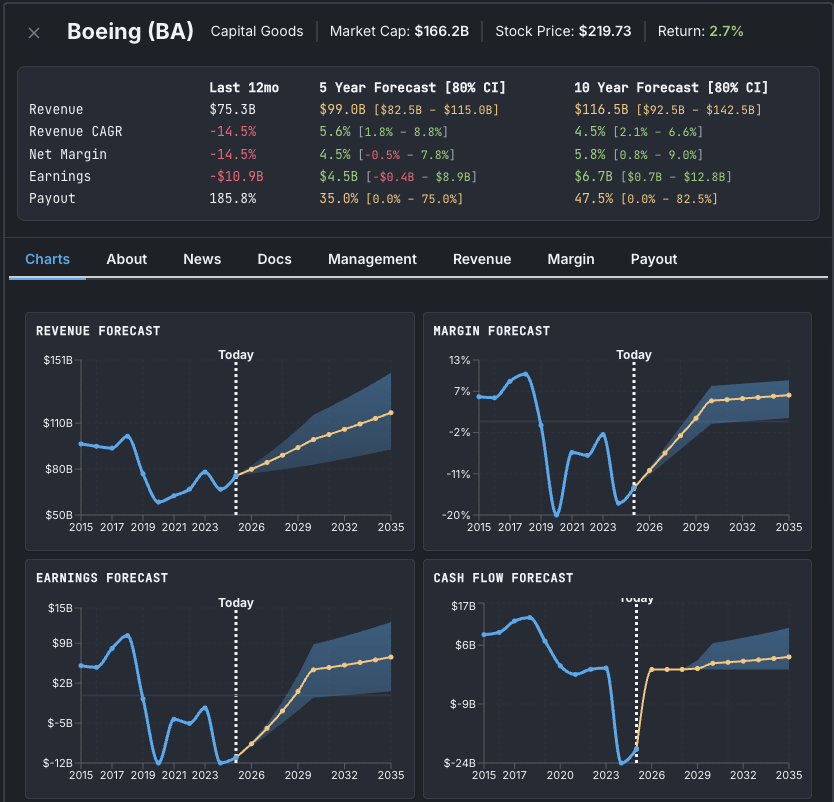

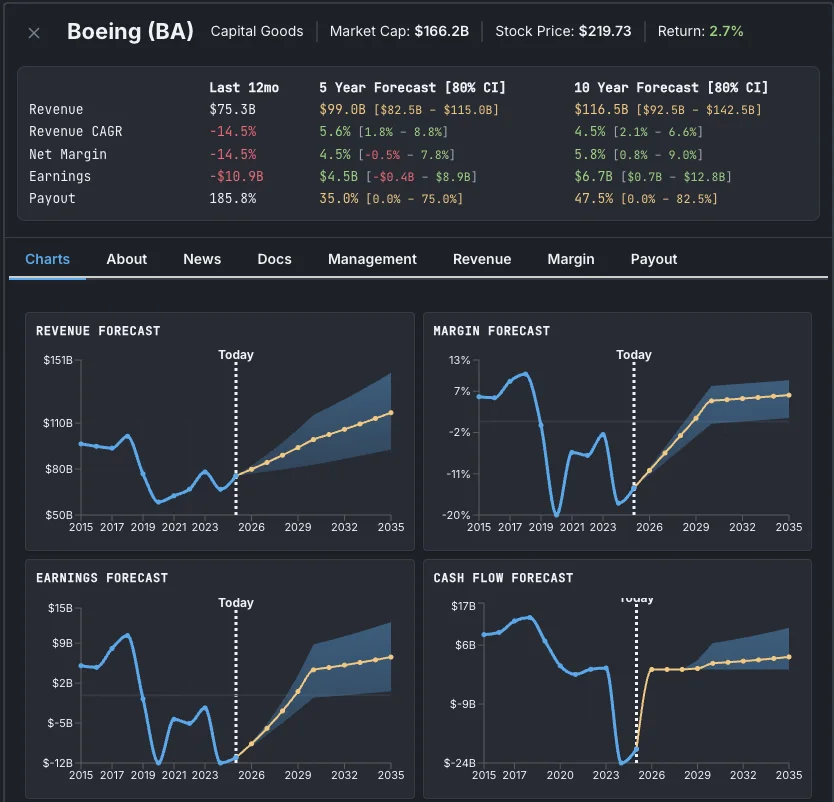

For example, Boeing's management receives a low reliability score because they've missed virtually every major financial and operational target by enormous margins over the past 3-5 years. This quantitative assessment of management credibility helps investors avoid anchoring on overly optimistic internal projections.

Detailed, Transparent Forecasts

You can read all of this research yourself on the detail page for every company. The results are detailed, justified 5-year and 10-year forecasts of revenue, net margins, and payout ratios of 3,000+ companies.

All of this research is transparently available. (See here for how we benchmark and evaluate our research and forecasting).

Try Stockfisher Today

The 50 largest companies are free with no sign-in to explore in full. To see the largest 100 companies, create a free account.

To unlock the full S&P 500, subscribe for $199/quarter.

To unlock the full Russell 3000, accessing the companies with the highest expected returns, subscribe for $1999/quarter.

Stockfisher is already proving transformative for investors who want rigor without spreadsheets. Explore the tool at stockfisher.app, click any company to see its detailed forecasts, and watch our short video introduction below.

The Future of Investment Research

We believe accurate, probabilistic forecasting will redefine how investors understand long-term returns. Stockfisher is the first step in that future—bringing the rigor of fundamental analysis to every publicly traded company at scale.

Whether you're a professional investor managing a portfolio or an individual seeking to identify mispriced opportunities, Stockfisher provides the analytical foundation that value investing requires but traditional tools fail to deliver.

Disclaimer

The Company is providing the information set forth herein on an "AS IS" basis for use by the receiving party at its own risk. The Company has prepared this app based on information available to it, including information derived from public sources that have not been independently verified. The Company disclaims all WARRANTIES, WHETHER EXPRESS, IMPLIED OR STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF TITLE, NON-INFRINGEMENT OF THIRD PARTY RIGHTS, MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE. THE INFORMATION HEREIN are not guarantees of future performance and undue reliance should not be placed on them. Any forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.