Update, Sept 18 2024: See updates based on new leaks.

Key Takeaways

- These June 2024 numbers represent the first accurate data points for OpenAI's consumer, enterprise, and API revenue, allowing modeling of their growth rates and revenue trajectory through 2025 and beyond

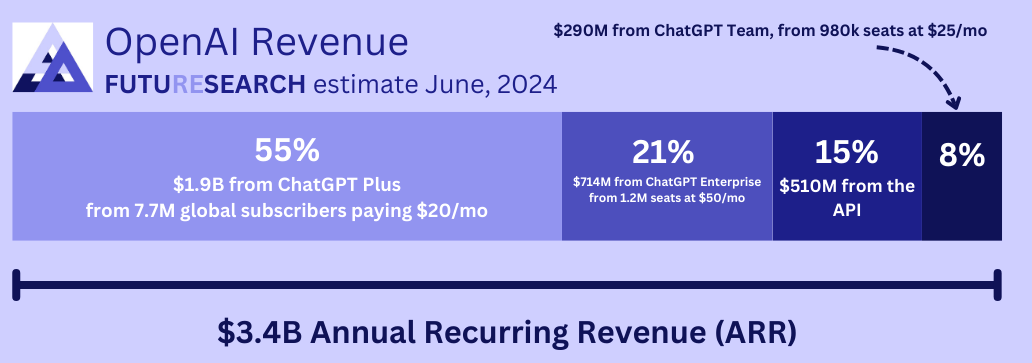

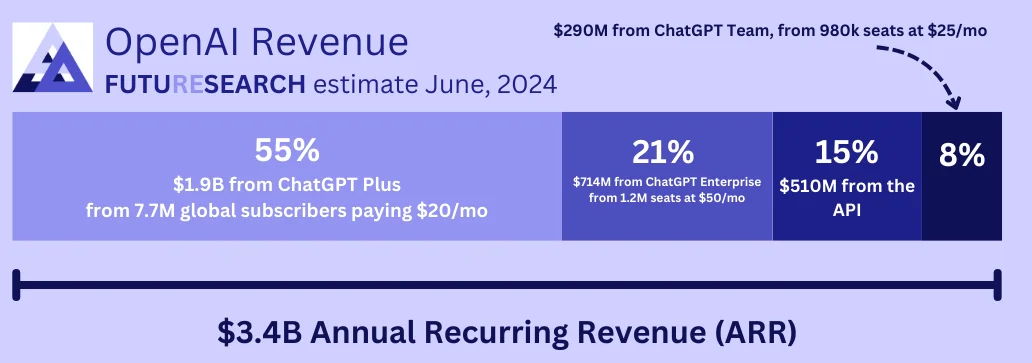

- In June 2024, individual ChatGPT Plus subscribers generated the majority of OpenAI's revenue, representing the largest share of the $3.4B ARR

- ChatGPT Enterprise was experiencing explosive growth in mid-2024, potentially becoming one of the fastest-growing enterprise software systems in history

- As of June 2024, all OpenAI products remained in early stages, with US revenue disproportionately high compared to mature global software products

- API revenue represented a smaller portion of total ARR in mid-2024 than was commonly reported in mainstream coverage at the time

ChatGPT Plus Drove the Majority of Revenue in Mid-2024

Much has been said about the rapid growth of ChatGPT as a product and business. However, our June 2024 analysis of relative growth rates across different product lines revealed surprising patterns that challenged common assumptions about OpenAI's business model at that time.

As of June 2024, individual ChatGPT Plus subscribers represented the lion's share of OpenAI's $3.4 billion ARR, far outpacing both enterprise products and API revenue. This consumer-first revenue profile differed significantly from other major AI companies, where enterprise contracts typically dominate. The finding suggested that OpenAI's consumer brand strength was its most valuable asset in mid-2024.

Enterprise Adoption Was Accelerating Rapidly in Mid-2024

As of June 2024, ChatGPT Enterprise was experiencing rapid growth that positioned it as potentially one of the fastest-growing enterprise software systems ever deployed. Fortune 500 adoption was expanding at an unprecedented pace, with DNS record analysis revealing widespread deployment across major corporations.

This enterprise momentum was particularly notable given OpenAI's complex competitive landscape and the challenges of selling into large organizations. The speed of adoption in early 2024 suggested that enterprises viewed ChatGPT capabilities as mission-critical rather than experimental.

All Products Remained in Early Market Stages as of Mid-2024

Despite the headline $3.4B ARR figure in June 2024, all OpenAI products showed characteristics of early-stage market penetration. Revenue concentration remained heavily weighted toward the US market, significantly more so than mature global software products like Microsoft 365 or Salesforce.

This geographic concentration indicated substantial room for international expansion, though it also highlighted execution risks. The mid-2024 data suggested OpenAI had captured early adopters but faced the classic challenge of crossing the chasm to mainstream adoption in most markets.

Sources of Info on OpenAI Financials

This analysis synthesizes multiple data sources to construct a comprehensive revenue picture:

- Personal anecdotes from pricing discussions and sales calls with OpenAI representatives

- DNS record analysis revealing Fortune 500 companies deploying ChatGPT Enterprise infrastructure

- Executive interview transcripts from OpenAI leadership providing revenue guidance

- Core assumption: $3.4 billion ARR reported by Bloomberg and The Information in June 2024

The methodology combines top-down market sizing with bottom-up user count estimates to triangulate revenue across product lines. Later reporting validated key assumptions while revealing areas where initial estimates required adjustment.

Detailed Revenue Breakdown and Key Metrics

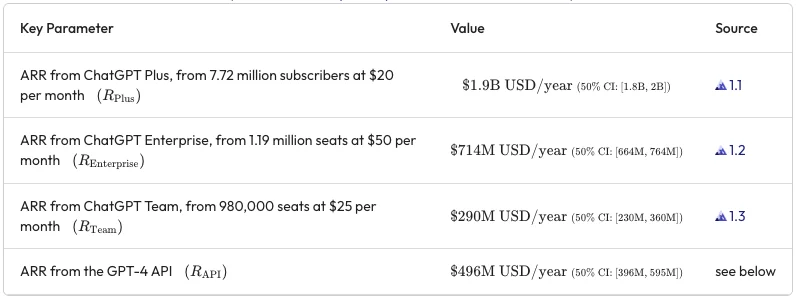

Revenue by Product Line (as of June 12, 2024):

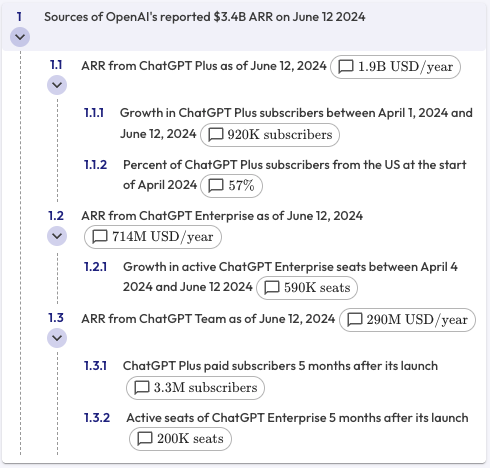

- ChatGPT Plus ARR: $1.9B USD/year (50% CI: [1.8B, 2B])

- From 7.72 million subscribers at $20/month

- ChatGPT Enterprise ARR: $714M USD/year (50% CI: [664M, 764M])

- From 1.19 million seats at 48, $55])

- ChatGPT Team ARR: $290M USD/year (50% CI: [230M, 360M])

- From 980,000 seats at $25/month

- GPT-4 API ARR: $496M USD/year (50% CI: [396M, 595M])

ChatGPT Plus Growth and Market Metrics:

- Subscriber growth (April 1 - June 12, 2024): 920K new subscribers (50% CI: [830K, 1M])

- US subscribers (as of April 1, 2024): 3.9M

- US market concentration: 57% of subscribers from US (50% CI: [55.5%, 58.5%])

- Early adoption baseline: 3.3M paid subscribers 5 months after launch (50% CI: [3.2M, 3.5M])

ChatGPT Enterprise Growth Metrics:

- Paid seats (as of April 4, 2024): 600K

- Seat growth (April 4 - June 12, 2024): 590K new seats (50% CI: [470K, 720K])

- Early adoption baseline: 200K active seats 5 months after launch (50% CI: [180K, 220K])

ChatGPT Team Conversion Estimates:

- Individual-to-Team conversion (from comparable app): 20/9 ratio (50% CI: [0.25, 0.6])

- Enterprise-to-Team conversion (from comparable app): 1.4/3.3 ratio (50% CI: [1.5, 3])

- Model weighting: 0.5 for Individual conversion, 0.5 for Enterprise conversion

Open Questions for Future Research

Several critical questions remain unanswered about OpenAI's business fundamentals:

- Cost structure: What are OpenAI's actual costs for ChatGPT Plus, Teams, Enterprise, and API services?

- Profit margins: Which product lines are profitable, and which are subsidizing growth?

- Growth trajectories: How will adoption curves evolve as the market matures?

- Market size limits: What are the realistic TAM ceilings for each product category?

These questions will become increasingly important as OpenAI faces pressure to demonstrate sustainable unit economics alongside revenue growth.